GCash continues to enable young professionals and micro, small, and medium enterprises (MSMEs) to unlock their financial goals through the many accessible digital financial services it offers like savings, loans, insurance, and even investments.

GCash recently shared that young professionals are becoming more independent, budget conscious, and open to trying simple ways to earn more while owners of MSMEs struggle to find accessible financing to expand their business and reach more customers.

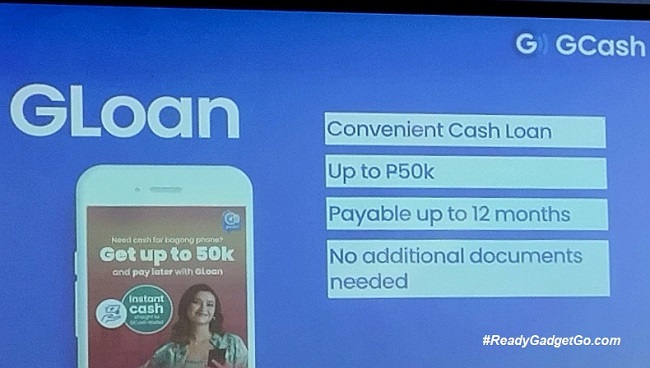

For the lending market, GCash specifically highlighted the access to credit for individuals and SMEs via the GGives and GLoans.

GGives is an easy pay-later option that allows users to purchase gadgets, appliances, furniture and even plane tickets, among others worth up to P50,000 from 85,000 partner stores nationwide and pay for them later up to 24 gives over 12 months.

GLoan, on the other hand, offers easy and fast cash loans up to P50,000 repayable up to 12 months with low interest rates and are suitable for digital entrepreneurs with growing online businesses.

Moreover, GCash has been ramping up its line-up of financial services to help individuals achieve financial freedom while giving micro to small entrepreneurs (MSME) the lifeline they need to keep their business afloat or the additional funds to support their expansion.

GCash has a slew of more services which help users manage their wealth and gain financial security. For example, GSave, a digital savings account, offers a higher savings rate of up to 2.6% per annum than traditional banks, and that lets users access their money 24/7 anytime, anywhere.

GInsure is a one-stop shop for insurance products that’s easy to understand, has a low premium but comprehensive coverage like personal accidents, medical services, car insurance, income loss, and even online shopping, bills, cars, and pets.

The mobile app can also help users manage their finances as it provides a real-time record of their digital transactions which can be accessed 24/7 on their smartphone.

Financial literacy and customer engagement through social media

Aside from introducing various digital financial solutions, GCash is also maximizing the use of social media in its drive to educate and engage the youth on the benefits of using the app and learning more about its financial services.

Users can find GCash’s educational content on YouTube, Facebook, TikTok, Twitter, Instagram where they can learn from financial and medical experts, inspirational celebrities and other social media influencers. These include tutorials, life-goal hacks, and personal stories. They also answer frequently asked questions on finances and discuss the advantages and disadvantages of certain financial products, offer tips to develop the right mindset and behaviors toward money to avoid financial mistakes.

With GCash services and its financial literacy projects, Filipinos can start early on growing their wealth, upgrading their lifestyle and future-proofing their finances.

GCash has been a trusted digital financial platform by millions of Filipinos especially as its operations is approved and regulated by the Bangko Sentral ng Pilipinas.

Since its launch in 2004, GCash users have increased to over 60 million, covering 83% of the Philippine population. Among them are at least 5 million merchants using the mobile app to accept digital payments from customers. In 2021, there were 5 times more active monthly users of GCash than the second largest competitor’s.

0 Comments